Sustained value creation as the primary objective.

We focus on long-term, responsible and value-creating investments in promising mid-market growth companies that are seeking sustained growth, operational excellence and market leadership while having a positive impact on the environment and society. In our focus sectors Healthcare, Tech-Enabled Services and Smart Industries, we thus develop market leaders – organically or through acquisitions ("buy and build").

We aim to invest in established medium-sized growth companies that are led by entrepreneurial management teams and strive for sustainable expansion, operational and digital excellence and market leadership while having a positive impact on the environment and society.

With our partners, we share our experiences in the form of expert and methodological knowledge. We are supported in doing so by a network of qualified experts who have acquired their leadership and expertise at medium-sized international market leaders. All of them are united by the passion for entrepreneurial success.

Core sectors

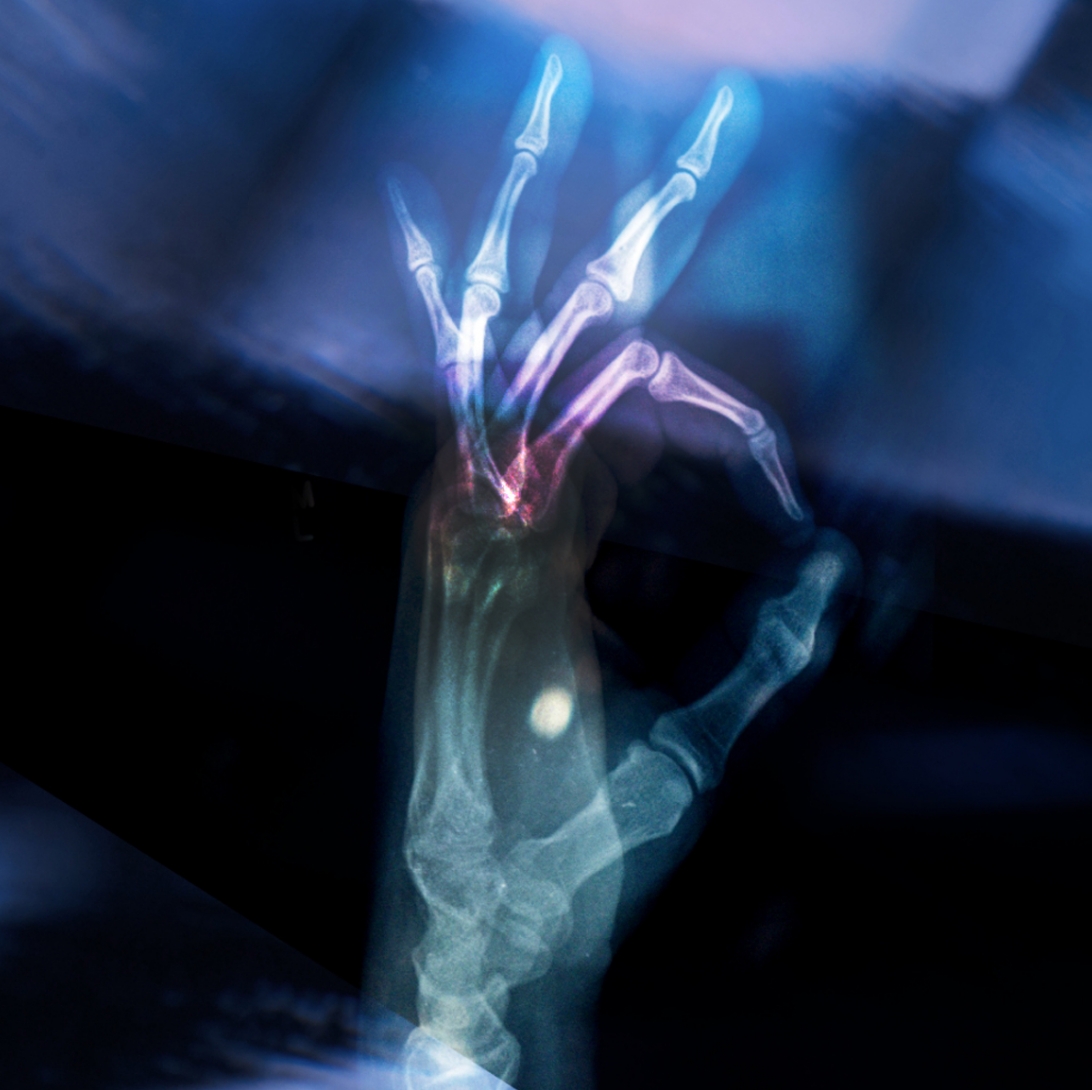

Healthcare,

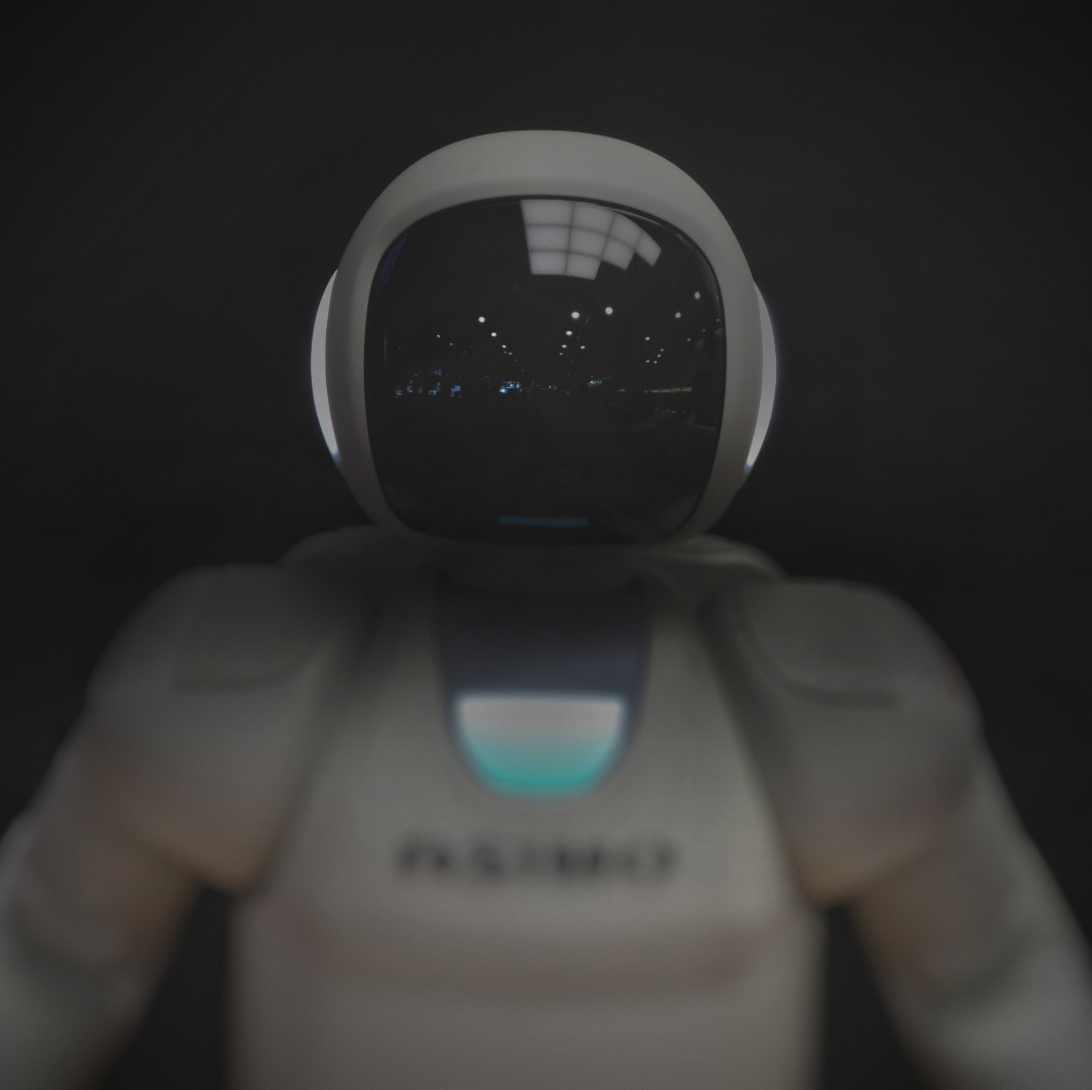

Tech-enabled services,

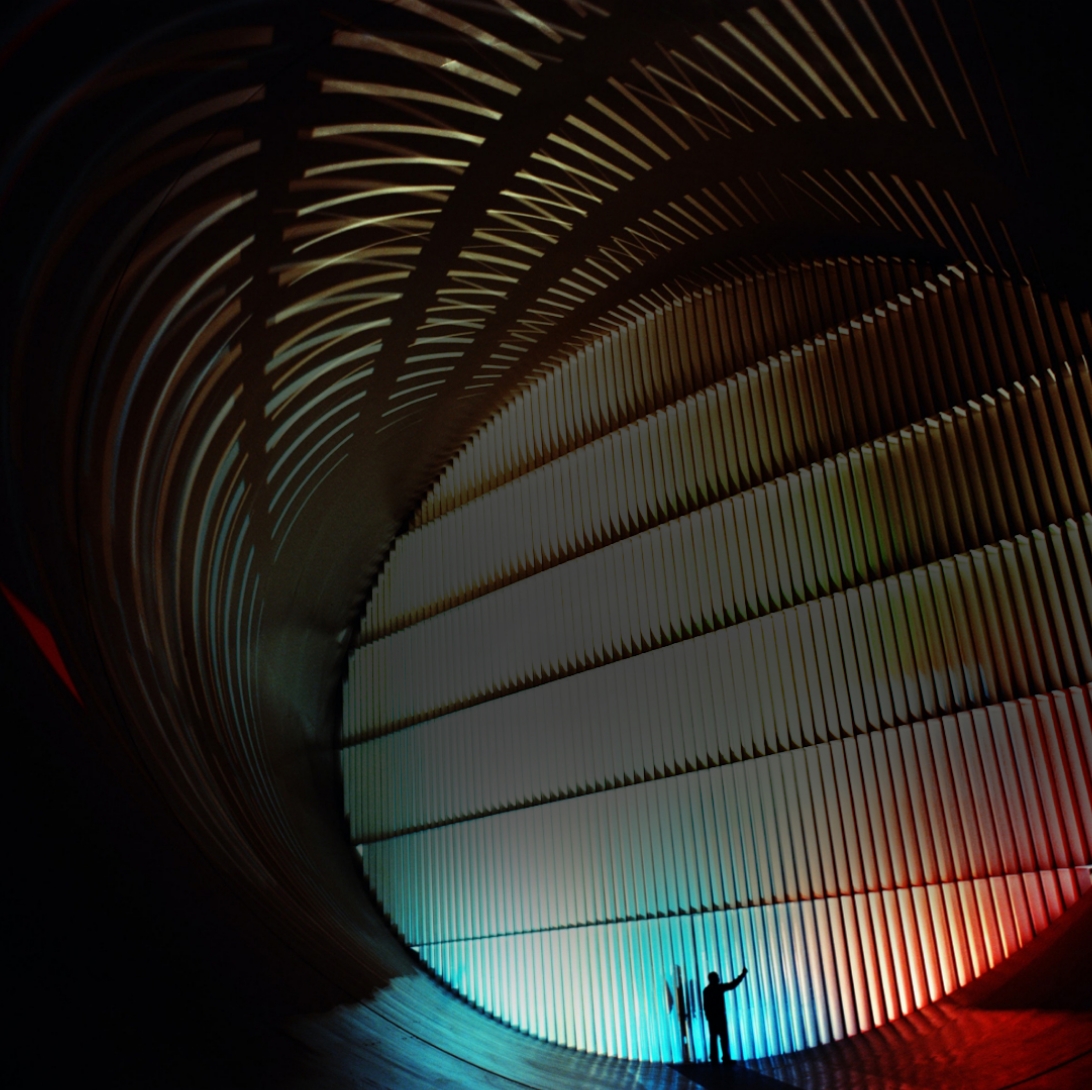

Smart industries

Sales volume

From 50 to 300

Million Euro

Focus on the

DACH region

Equity- Investments

Between 20 and 120 million euros

Focused on three industrial sectors. And a world of opportunities.

We deliberately focus on three industry sectors. In these sectors, we have in-depth industry knowledge and operational expertise. Management teams and companies alike therefore benefit from our decades of transaction experience in these attractive sectors.

Two ways. One goal.

We focus on two different target groups:

Platforms + Buy & Build

We focus on platform companies that aim for organic and inorganic growth via add-on acquisitions. The responsible management teams can draw on our broad experience from numerous platform success stories in the Quadriga Capital portfolio.

Technology-based medium-sized companies

We concentrate on market leaders in international niche markets – or those who want to become such leaders. The support of the management teams in the further development and expansion of their market-leading position is our primary objective, e.g., through acceleration of digital transformation or internationalization strategies.

Experienced. In every situation.

The many different situations that call for an equity capital solution are reflected in the range of possible investment scenarios:

- Succession solutions

- Disposal of non-core subsidiaries („carve-outs“)

- Management buy-outs and buy-insn

- Implementation of consolidation strategies

- Acquisition of listed companies (public-to-private's)

- Growth financing

Potential vendors include families, founder-owners, other private equity companies, corporate groups, shareholders of listed companies and public owners. Tailored acquisition strategies ensure that the needs of the vendors are met.

Clear criteria. Open to great ideas.

The Quadriga Capital funds invest primarily in Germany, Austria, Switzerland and neighbouring countries.

Key criteria for an investment by the Quadriga Capital funds include:

- Strategically attractive markets with long-term growth prospects, backed by megatrends

- Leading market position or the potential to achieve one – based on a distinctive brand, strong corporate culture and sustainable USPs

- Sustained positive impact on the environment and society or the potential to expand it

- High potential for improving the competitive position through digital transformation or for accelerating it

- Long-term growth prospects due to dedicated expansion and transformation strategies: organic, via acquisitions or through roll-out

- Company values between EUR 50 and 250 million

- Equity capital investments between EUR 20 and 120 million

- Primarily majority stakes, or in exceptional circumstances qualified minority stakes

Contact

Quadriga Capital Eigenkapitalberatung GmbH

Hamburger Allee 4

60486 Frankfurt

T +49 (69) 795 000-0

F +49 (69) 795 000-60

contact@quadriga-capital.de

2025 © Quadriga Capital